IFA column: Work together better

It’s fair to say that when solicitors and IFAs work together, the client outcomes are typically better. I think it’s also fair to say that the clients themselves come away with more reassurance and confidence about their future, especially financially. So, why doesn’t this teamwork happen more often? And, when it does happen, what does “good” look like?

Well, the first question is probably the easier one to answer. As we all know, the ideal situation is to be working with a Resolution Accredited Specialist in Financial Planning on Divorce, but the problem is there aren’t many of us.

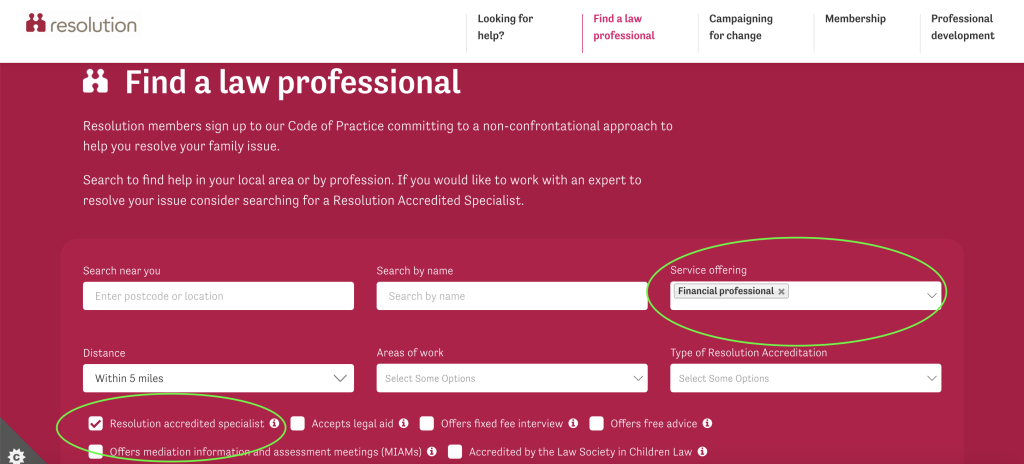

Having said that, we’re not too hard to find. On the Resolution website, click on Find a law professional, then click on “Advanced Search”, then choose “Financial professional” from the “Service offering” drop down box and tick the “Resolution Accredited Specialist” box….voila!

Most of the work I do is as a shadow expert and it’ll come as no surprise that the main area of help needed is in pensions. I’m fortunate to have several good relationships with solicitors and, over the years, we’ve improved the way we work with each other. So, in terms of what “good” looks like, I thought a couple of case studies might be helpful.

Case study 1

The people in this case study are: Solicitor = A, Client = W and Other side’s client = C

This is a case we’re working on currently, so I don’t know the outcome yet, but the way in which it has worked so far has been excellent – W has felt really reassured with the combined support she’s received from myself and A.

I work regularly with A and she contacted me earlier this year to explain that some help would be needed on pensions and other finances in this case. W and C are both in their early 60s and separated in 2022 after a long marriage. Things had moved slowly for several reasons, but both parties were now in a better position to assess options and seek a settlement. I spoke with A on the phone and she explained some of the background – C had his own business and a background in finance, and was being quite opaque with his disclosure, especially around pensions. There were no DB pensions involved, but C had property in a SIPP, which needed to be understood better. She also explained that W had very little financial understanding and financial provision of her own, having reduced and then stopped work some time ago to raise their family (three adult children). W had virtually no assets in her name, no income and very little pension provision (all in one DC pension scheme). A felt that a joint meeting between us and W would help and I agreed. Prior to the meeting, A provided me with all the financial disclosure she’d received so far and an email summarising the overall position. This information was crucial in giving me the insight into the finances, the overall position and W’s current state of mind prior to the meeting.

The meeting took place at A’s office and I was able to explain the important aspects of the finances to W in terms she could understand – W is highly educated and intelligent, but, like many people, finds finances difficult to understand. We were also able to outline a plan of what kind of settlement would work for her, taking into account her housing needs, her retirement income needs, accessibility to emergency funds and tax.

Following the meeting, I drafted some pension questions for A to ask C’s side, with particular focus on the property SIPP. These questions delivered the further disclosure we needed to understand the pension better. The information was also more forthcoming and thorough than it had been before, perhaps because the questions were so specific.

We’re now in a position where, following the FDR, C’s side has put forward a settlement proposition for the pensions, which will result in a counter-offer because there are crystallised and uncrystallised elements to the pensions, which require further analysis for a fair outcome. We’re close to reaching agreement on this and, when we do, the rest should fall into place. Most importantly, W feels more informed and confident about her future than she has at any point since the separation, which is really what this is all about.

This is what good looks like – early involvement, excellent information, consistent communication, realistic expectation management and genuine teamwork.

Case study 2

The people involved in this case study are: Solicitor = S, Client = C, Client’s brother = D, and Other side’s client = J.

In this case, the initial contact was made by D, who was helping C as she was struggling mentally with her divorce and she also had a history of physical health issues. D actually found my details via another IFA, who doesn’t specialise in divorce work, but knows me, so referred D to me.

My involvement started after the PODE report was issued and D was looking to help C understand the report and her options going forward, in order to assist with getting a settlement in place.

C was in her mid-40s and J was in his late 50s. J had a local authority DB pension with a large CEV and C had very modest pension provision in comparison. J earned considerably more than C and, whilst there was no mortgage borrowing capacity report instructed, it was clear that C may have struggled to attain the mortgage required for a suitable property and, even if she could, she had her own concerns over maintaining it on her own because of her health issues. The other assets in the marriage were very modest. It was clear that C’s main priority was for the settlement to include appropriate housing for her. The length of the marriage was around 15 years and there were no children.

D shared a range of information with me, although it took some time for him to gather all of this. The information included the PODE report, Form Es and some email exchanges between him, C and S. I should stress that I’ve never met S, so am completely unfamiliar with her normal working practices. However, after the PODE report was issued, S suggested C should seek independent financial advice to understand the report and her options better, which D clearly followed in contacting me. However, it was interesting to note that S did not recommend an IFA to work with. It was also clear that there was no IFA involvement in the instruction of the PODE report, which had 11 questions for the PODE to answer. A number of these were, in my opinion, not really relevant to the circumstances of the case. The PODE report was certainly needed, especially given the nature of J’s pension and the age gap, but I felt it could have been more concise.

Prior to me writing my letter for D and C, J’s side put forward an offer which included an offset calculated in the PODE report – unsurprisingly, this used the figure that was calculated excluding non-marital accrual. S commented on this offer saying that it would achieve C’s main objective of securing the FMH (assuming she could take on the remaining mortgage), but didn’t comment on her future retirement needs and how diminished these would be as a result of J’s side using the marital accrual figure only. My letter did comment on this aspect and the disadvantage it could put C at in the future, but I also made reference to discussing this with S to seek agreement with J’s side on how accrual should be treated.

This was a bit of a frustrating case. I was able to help my clients and I believe they’re now close to a more reasonable settlement, but had I (or any other Resolution Accredited IFA) been involved earlier, the PODE report could have been more concise (and, therefore, cheaper) and perhaps a settlement could have been reached earlier, with expectations being managed better. S had clearly identified that independent financial advice would be helpful, but perhaps she wasn’t aware of the value of earlier advice.

Hopefully, this article has achieved its purpose in encouraging better interaction between our professions because there’s little doubt that the more we work together, the better the outcomes we can achieve for our clients. I know many of you will have good working relationships with IFAs already, which is great, but for those of you who want to learn more about what we bring to the table, please contact one of us via the Resolution website for a coffee and a friendly chat.